2023 Annual Survey: Industry Reports Keeping Rates Steady Amid Rising Expenses

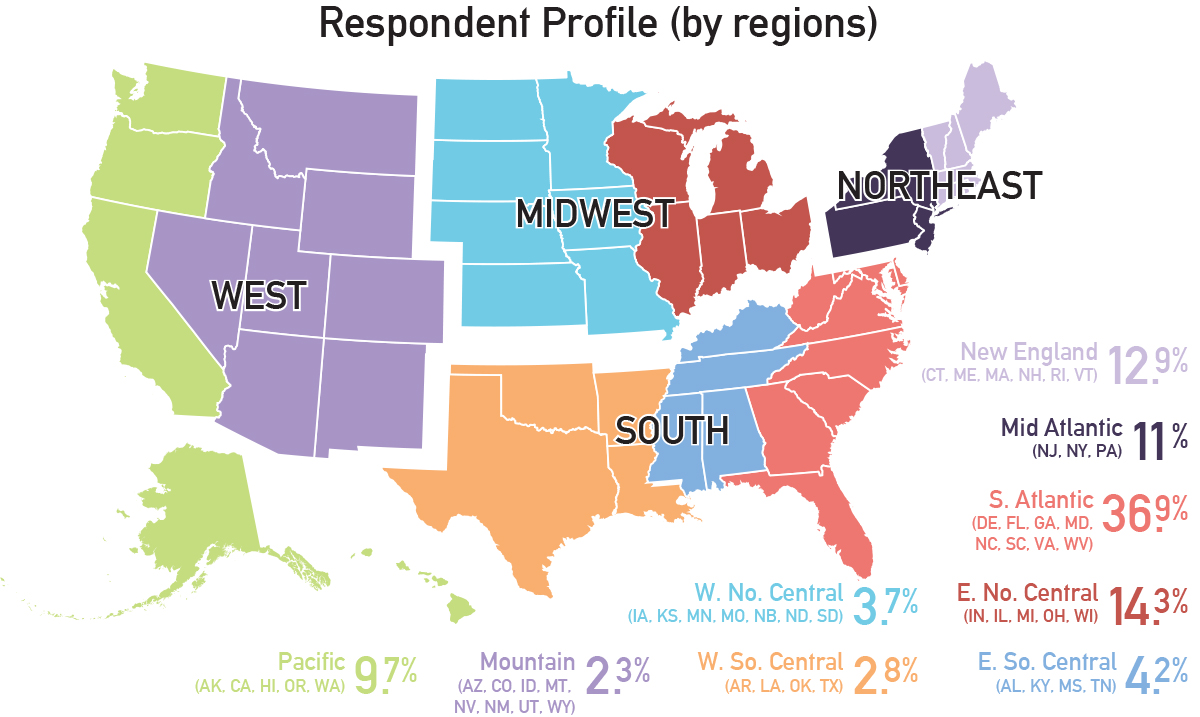

Published on February 27, 2024Editor’s Note: The Marina Dock Age Annual Marina/Boatyard Trends Survey was opened through the fall and early winter of 2024. We have combined our previous Operations Survey with Trends for an expanded view of marina/boatyard operations. Respondents from across the country answered questions about their facility, operations, revenues, profits, and more.

Respondent Profile

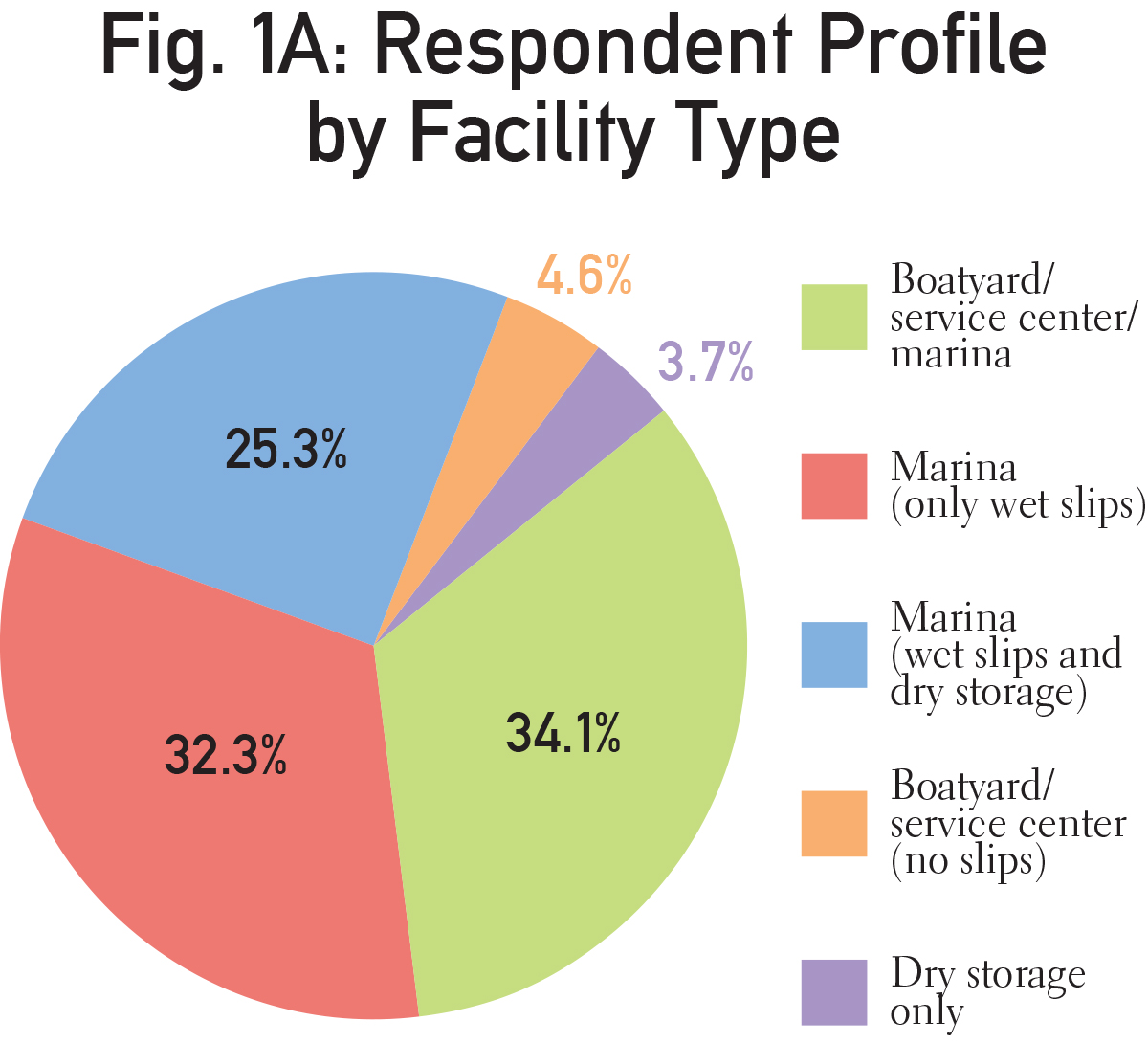

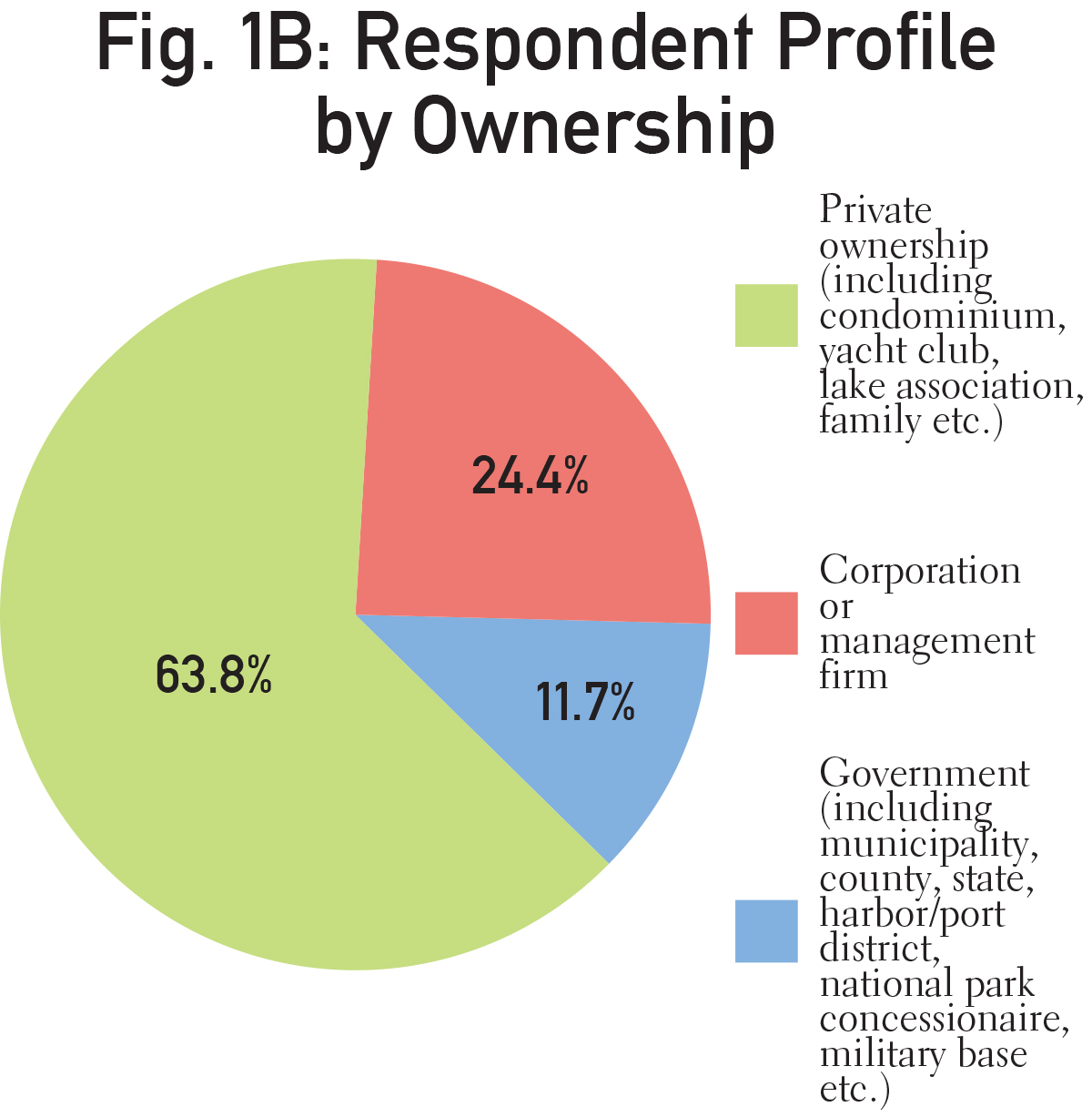

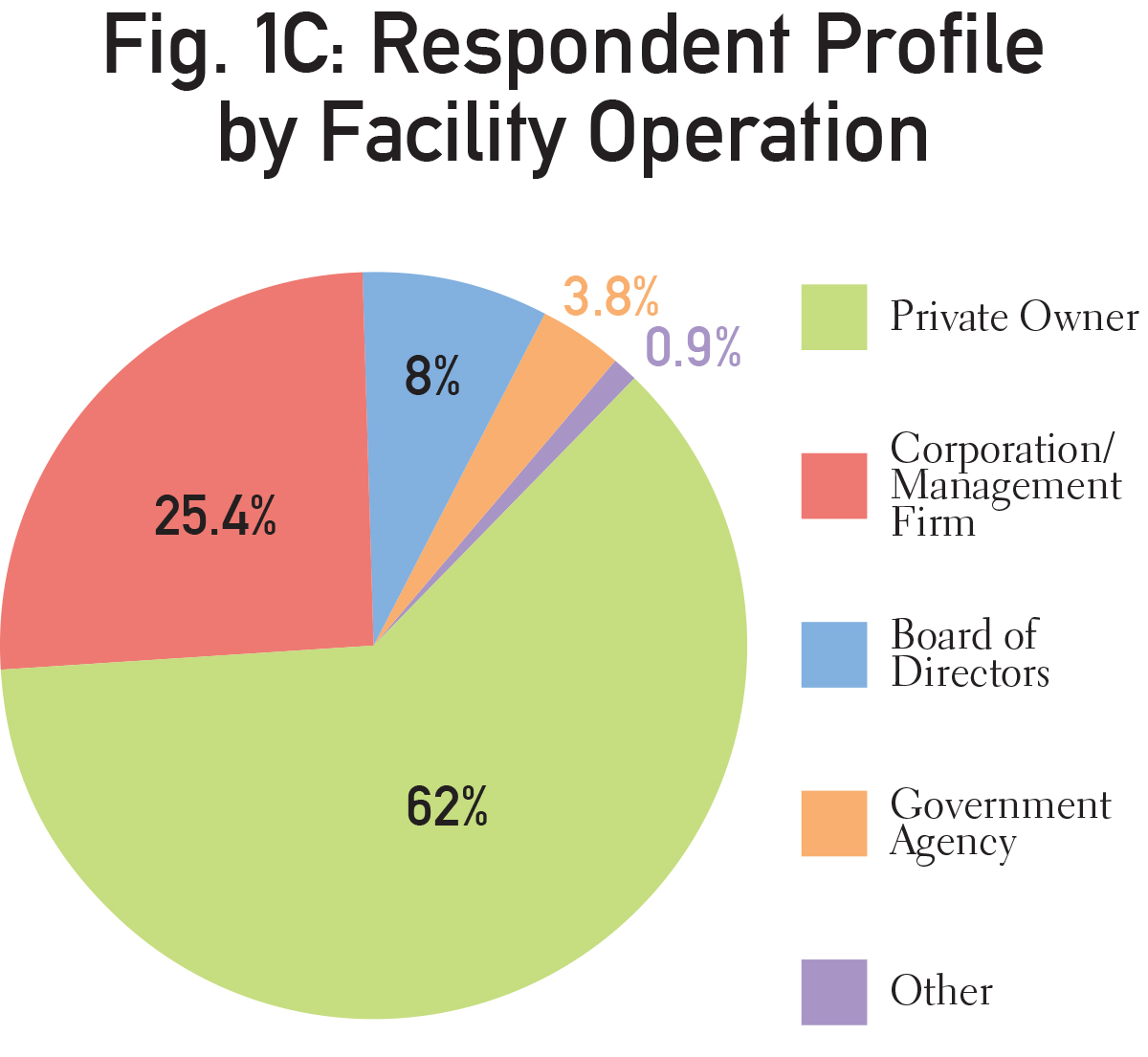

The respondent profile this year was mixed across all categories. Fig. 1A shows more than half identify as a marina rather than boatyard. Most facilities remain owned (Fig. 1B) and operated (Fig. 1C) by a private entity.

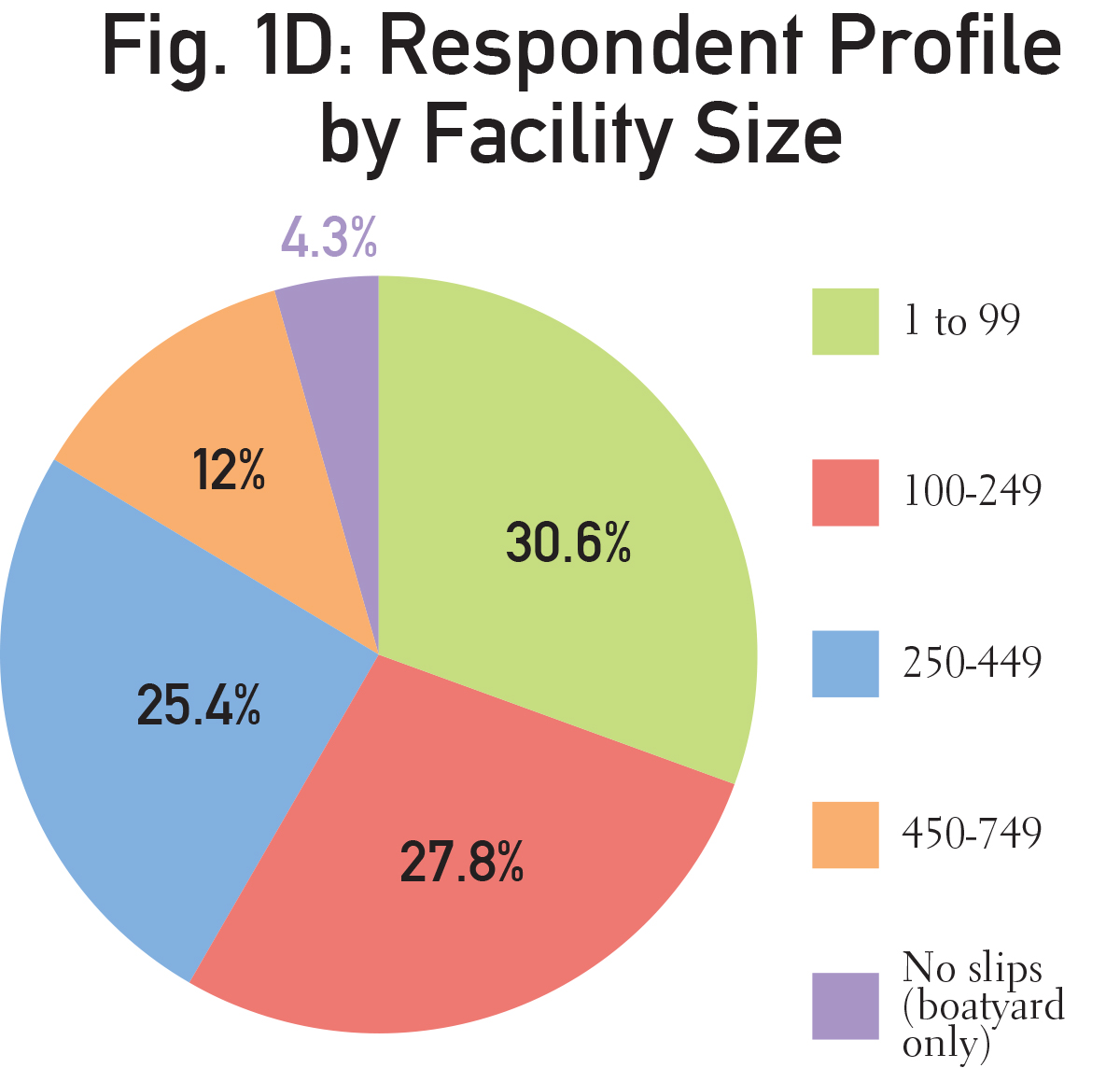

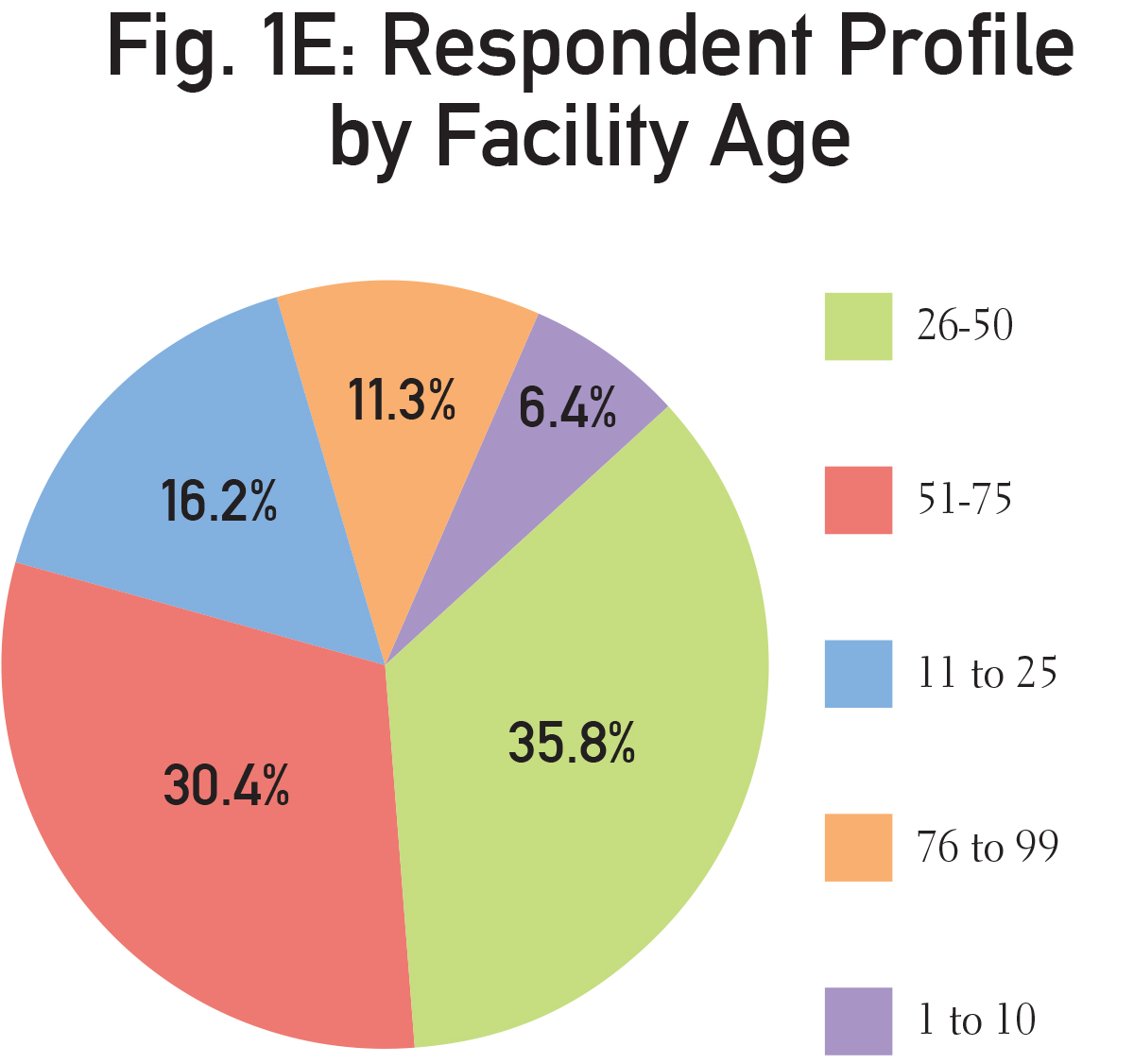

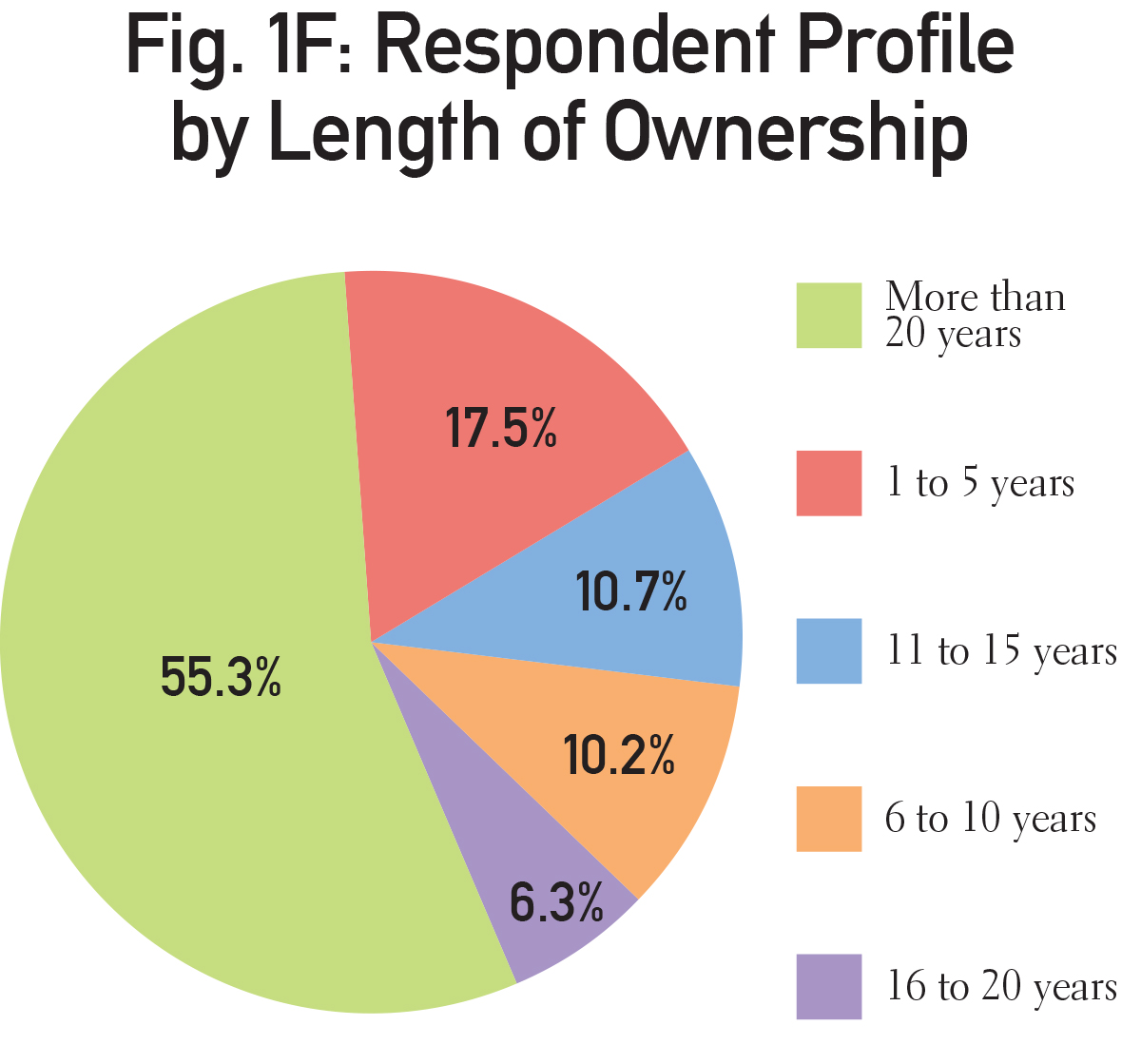

Most respondents had fewer than 500 slips (Fig. 1D) with a full 31% indicating the facility had less than 100 slips. Sixty six percent of facilities are older than 25 years (Fig. 1E), reflecting the lack of new building opportunities available. But the longevity of marina owners is apparent as a full 55% (Fig. 1F) have been in place for more than 20 years.

Occupancy and Rates

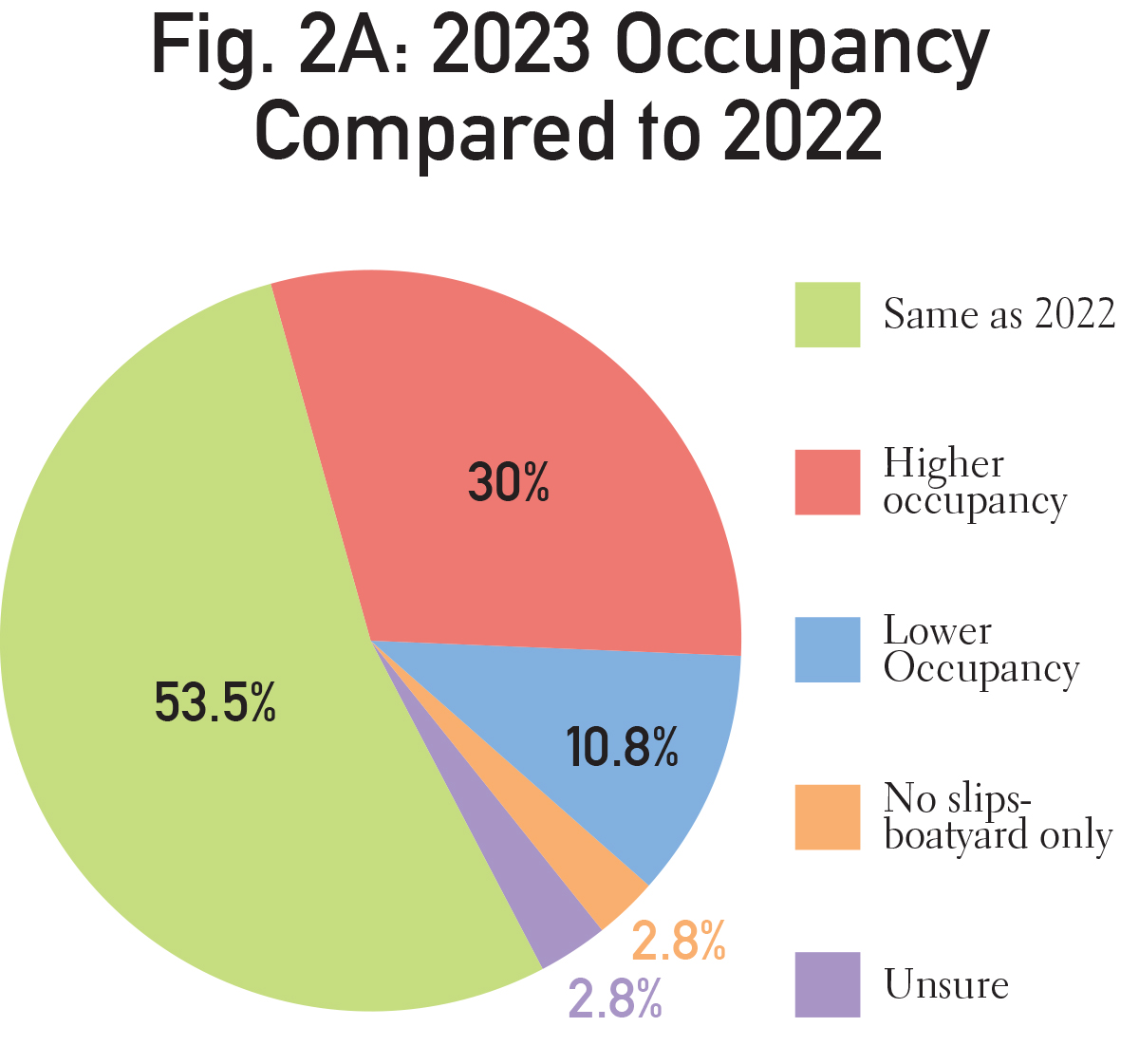

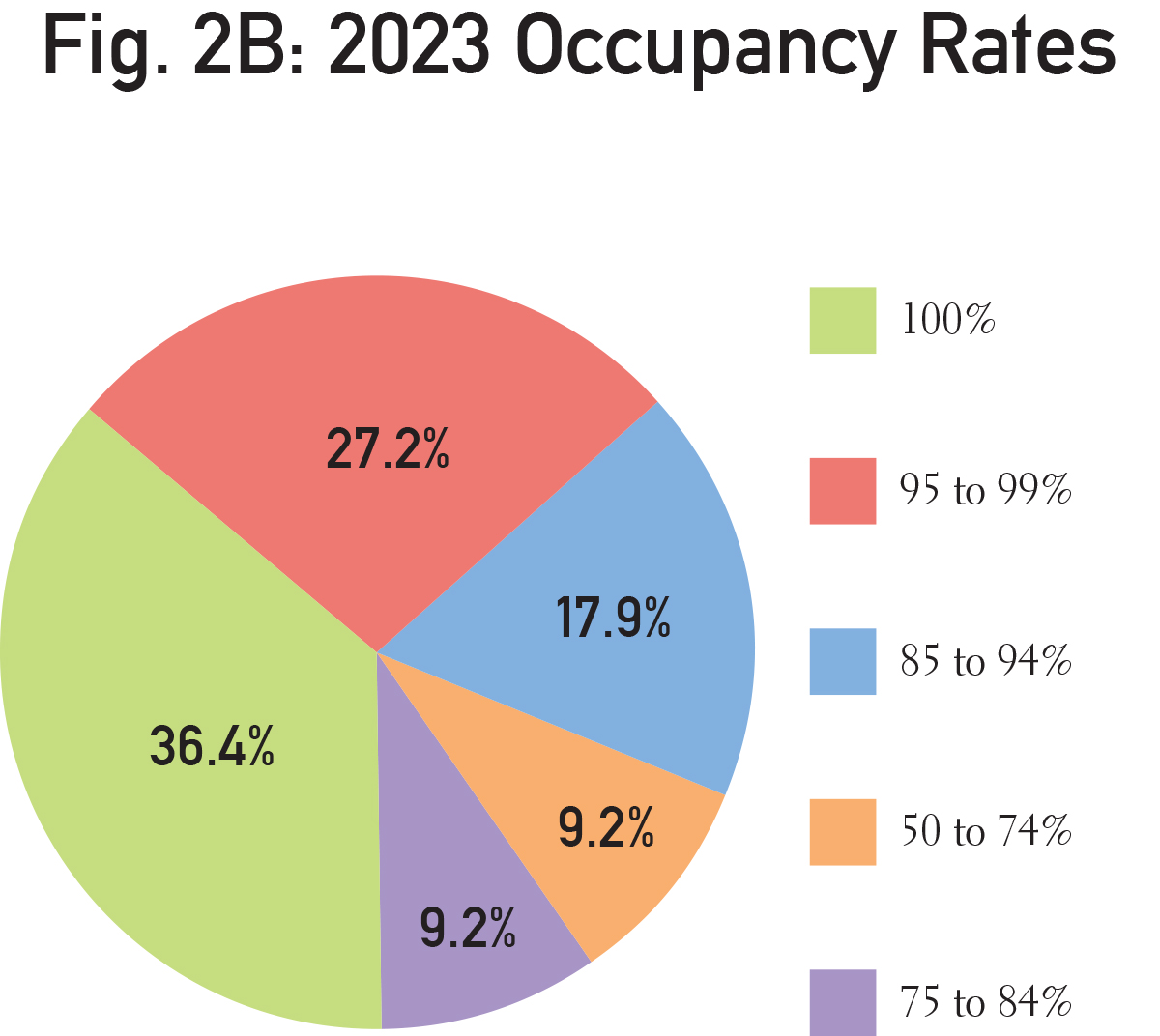

It was another good year for marina occupancy as 63% (Fig. 2B) of respondents said they have a greater than 95% occupancy and 30% (Fig. 2A) show a higher occupancy than last year.

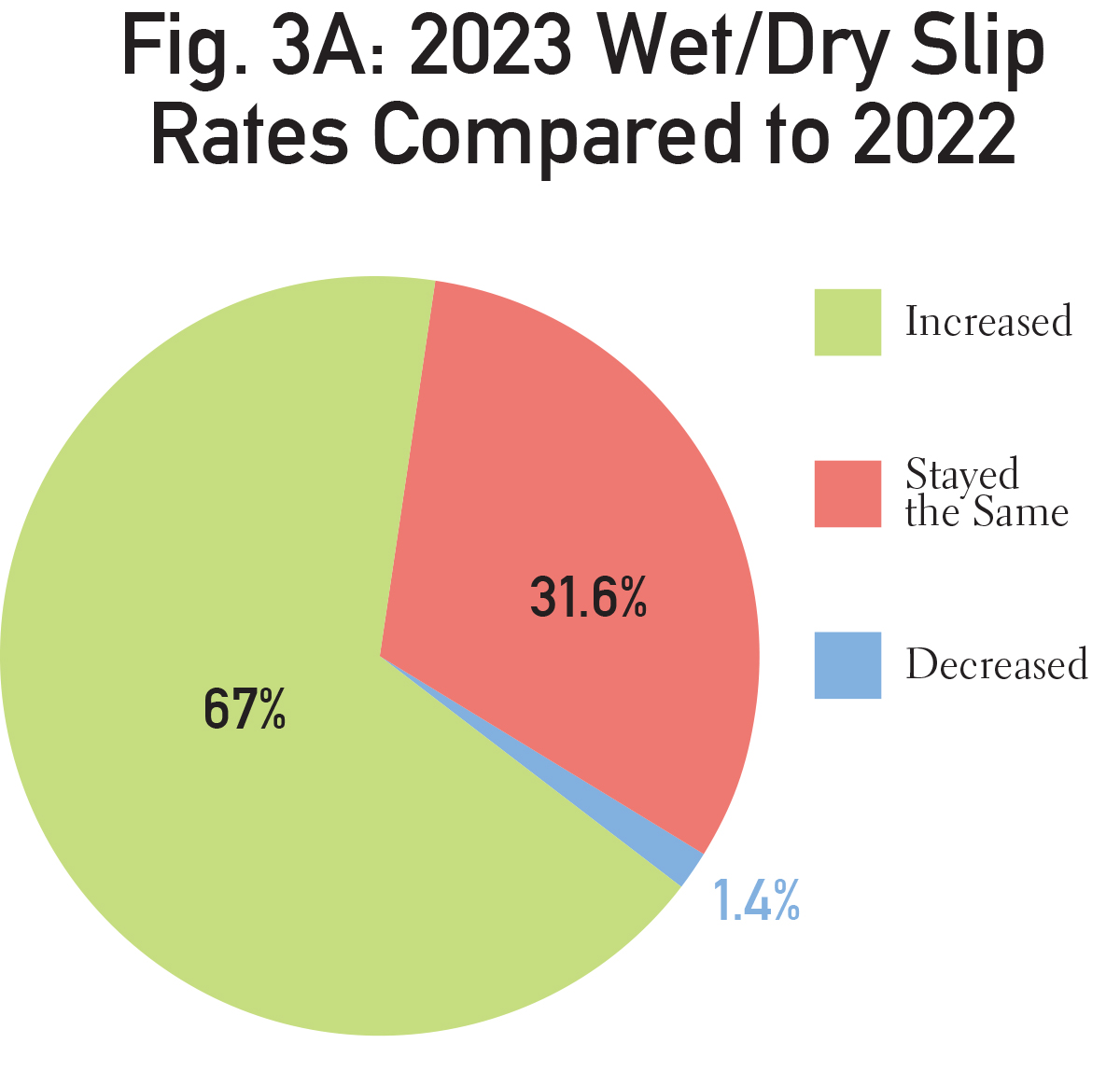

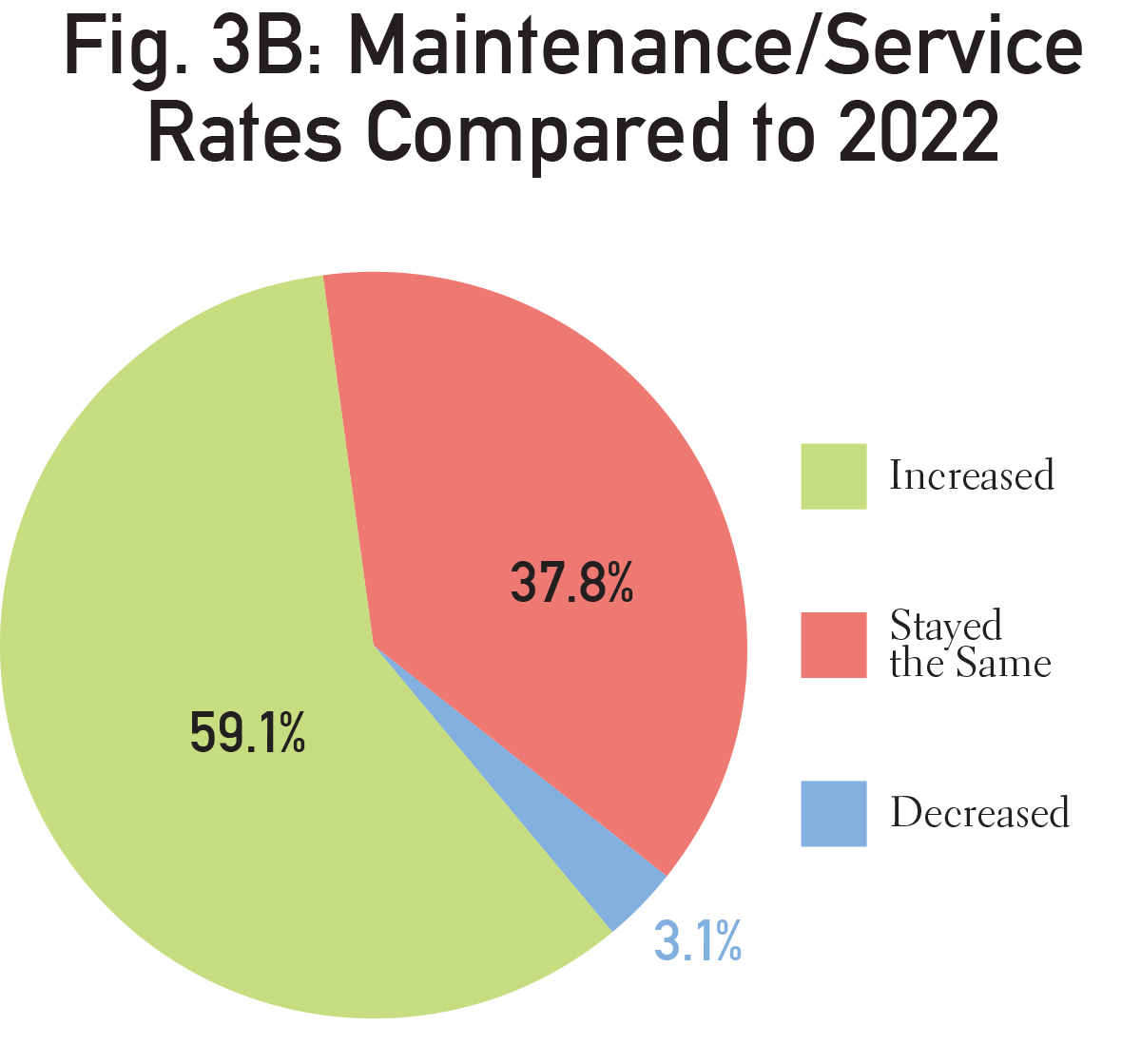

While word of inflation was on everyone’s mind last year, marinas chose not to add to their customers’ financial burden, with 67% (Fig. 3A) keeping rates for slips the same as the previous year and 59% doing the same for service/repair (Fig. 3B).

Expenses and Profits

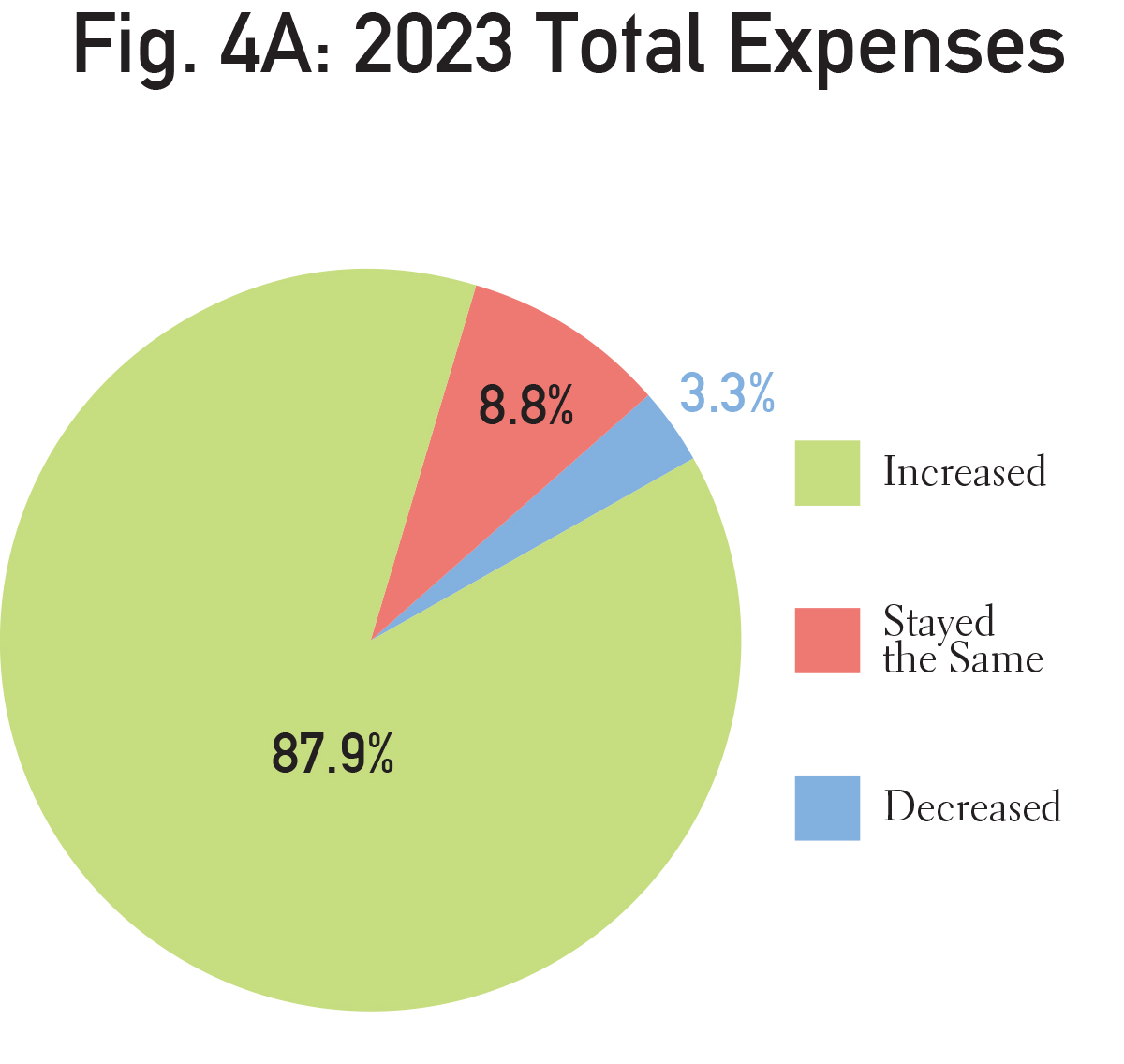

However, facility owners bore the brunt of creeping prices as a full 88% (Fig. 4A) reported their expenses had increased over 2022.

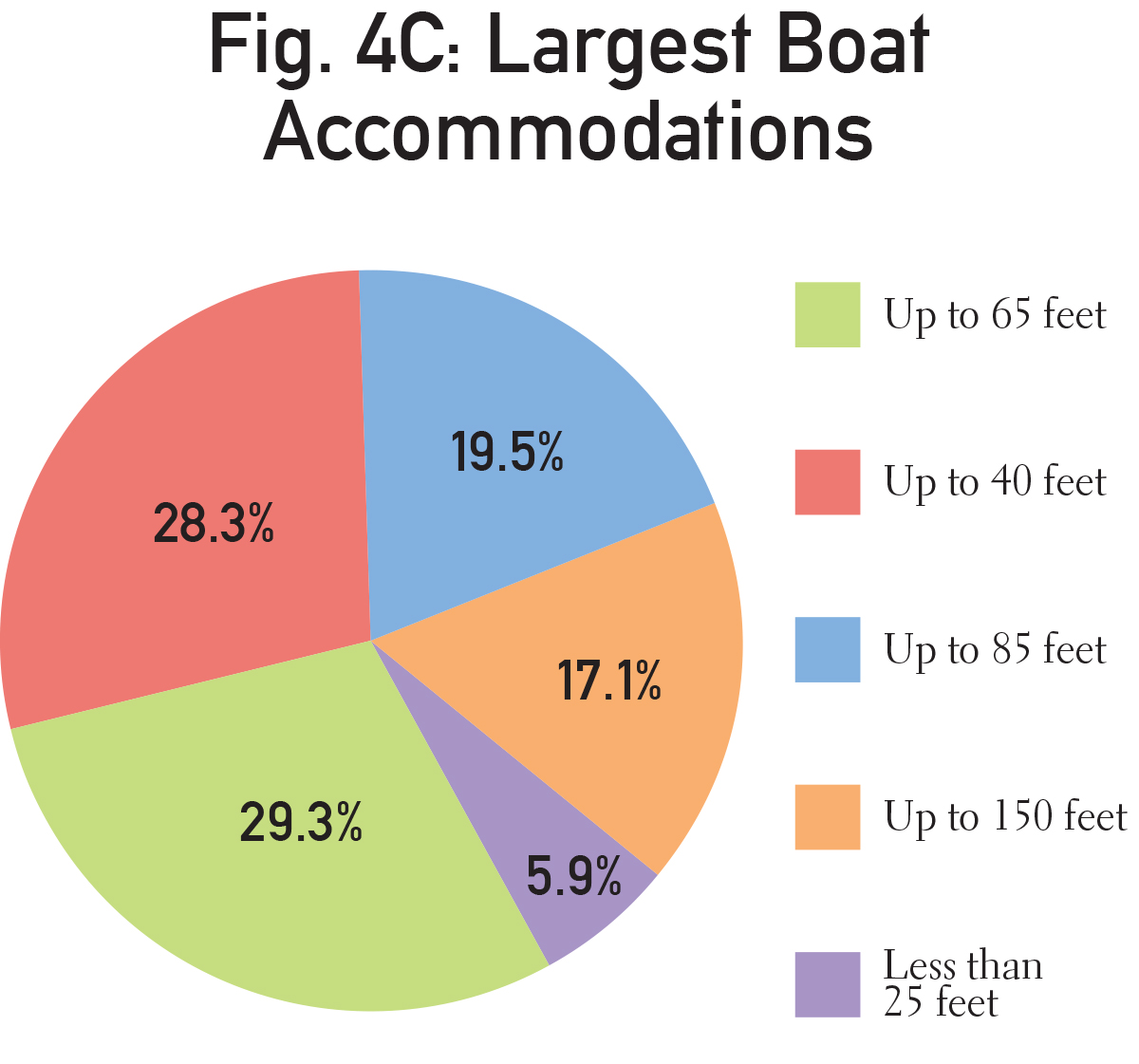

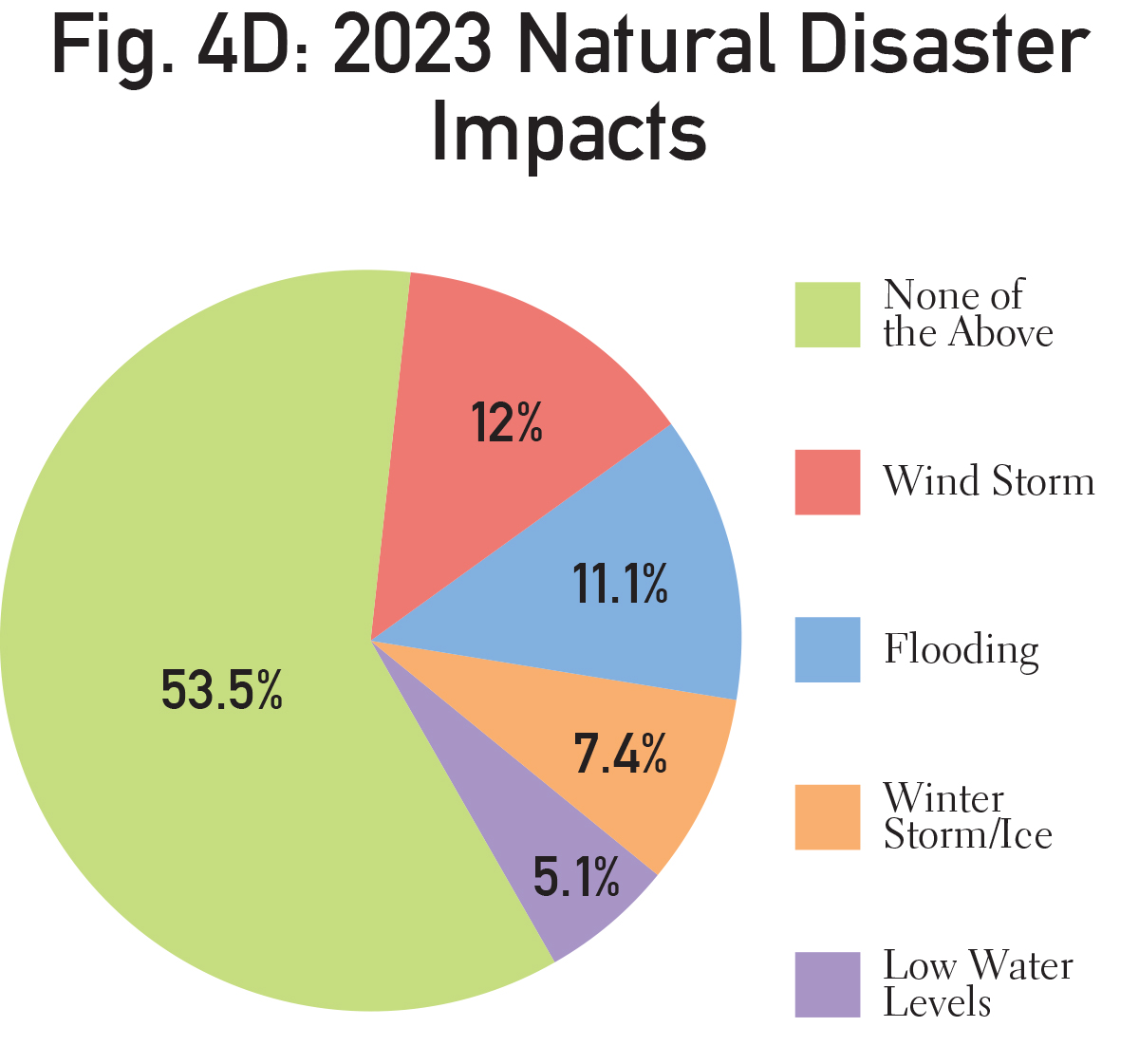

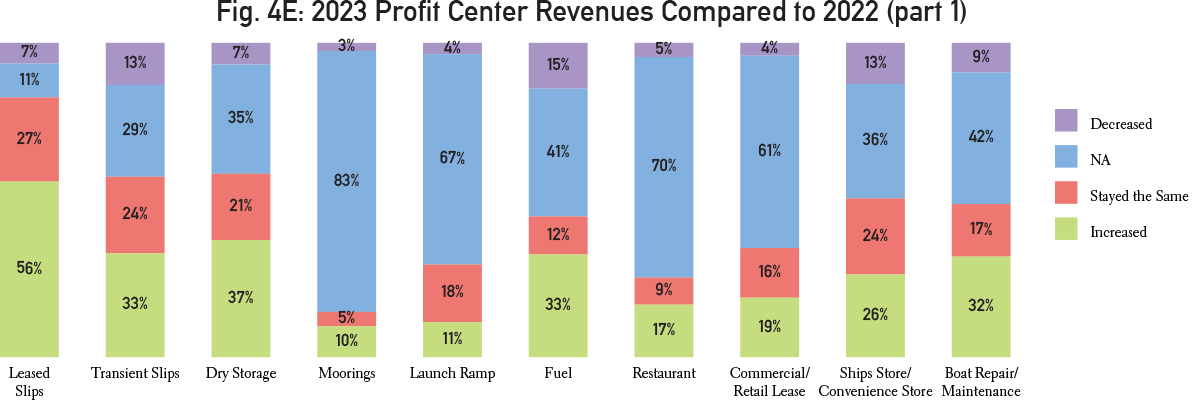

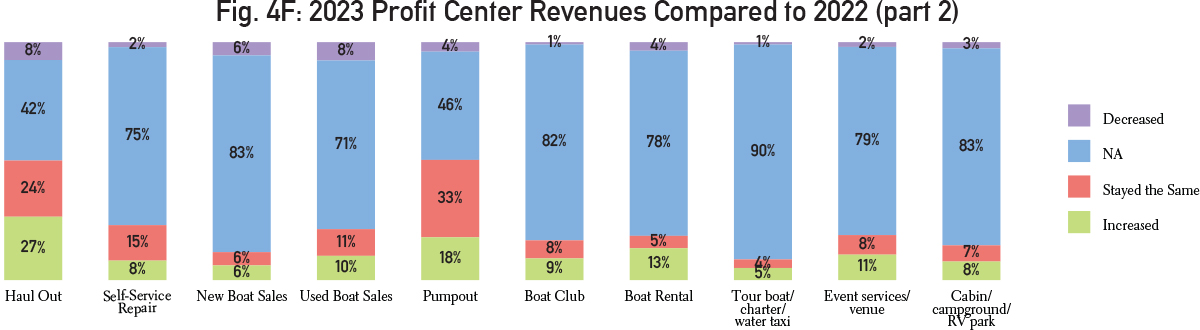

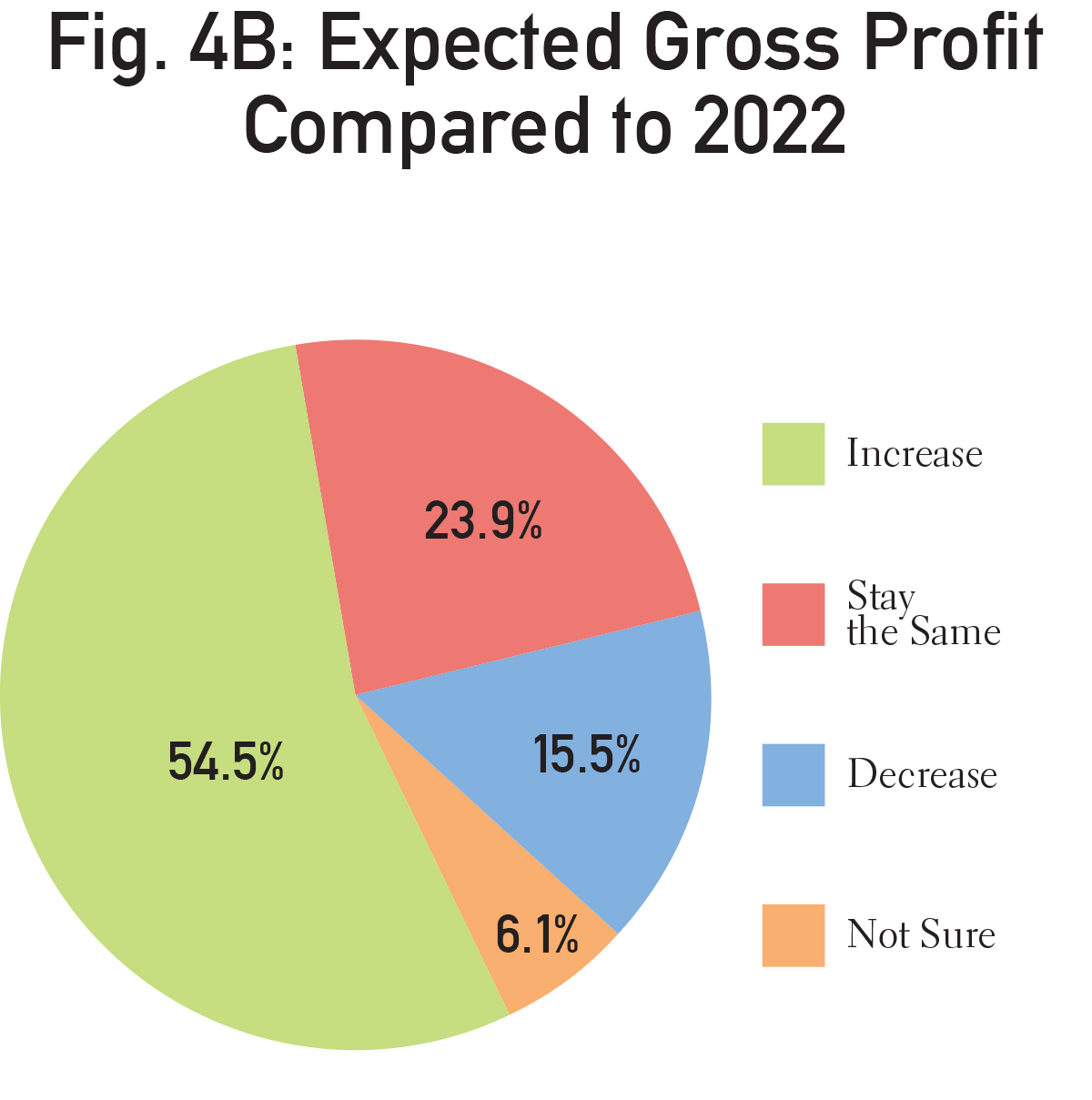

The silver lining was 54% (Fig. 4B) also said their profit increased from last year. Despite the rise in mega yachts. the majority of respondents could accommodate boats only up to 85-feet (Fig. 4C). Climate changes spared the industry in 2023, as more than half of respondents reported no impact from natural disasters (Fig. 4D). Figs. 4E and 4F dive deeper into how revenue from single profit centers compared to 2023. Across categories, the majority saw little change.

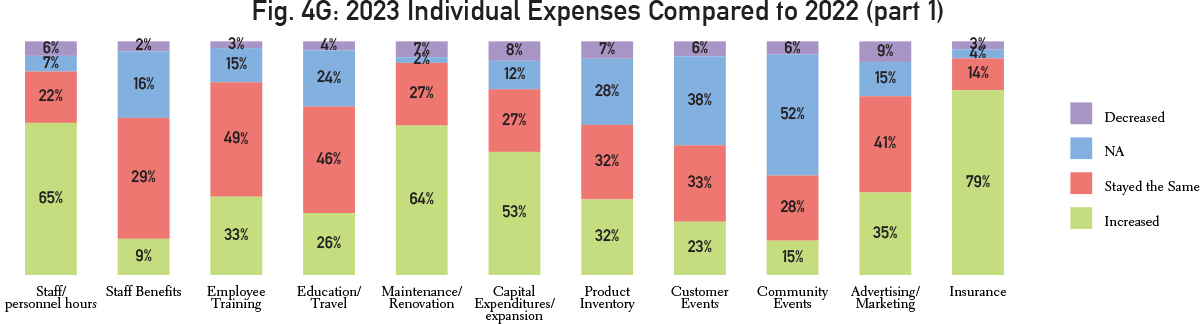

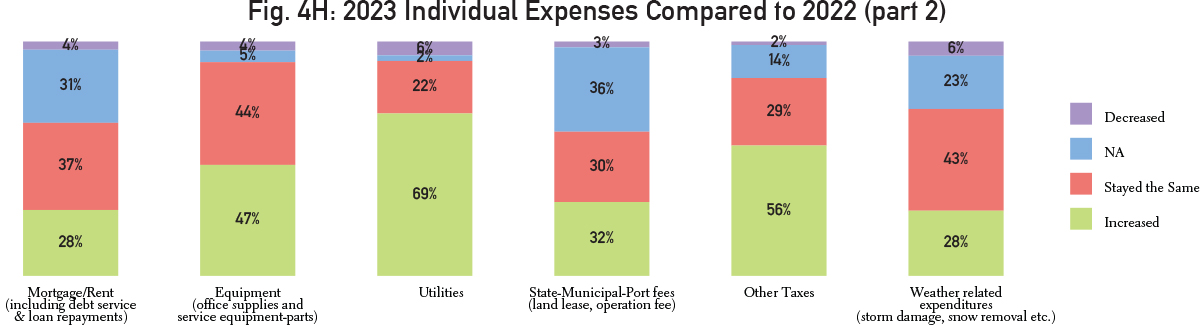

Expenses were also examined individually in Figs. 4G and 4H. Insurance was the winner for increased expenses with 79% reporting an increase. Utility and personnel costs also showed a rise with 69% and 65% showing an increase respectively.

Infrastructure and Training

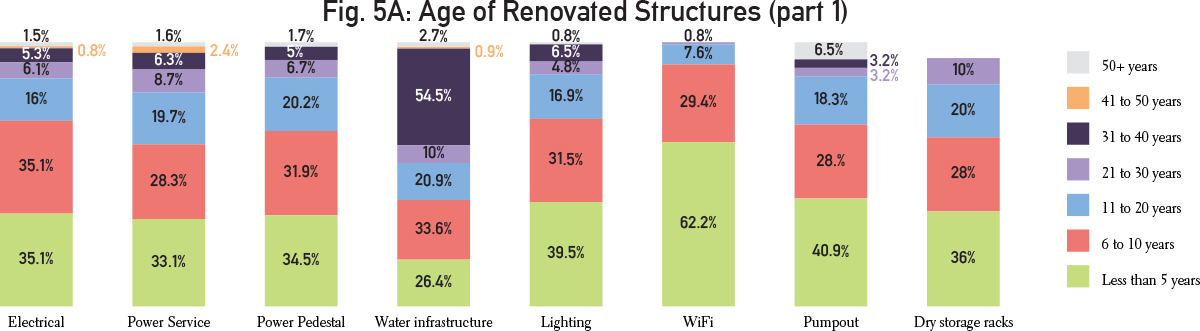

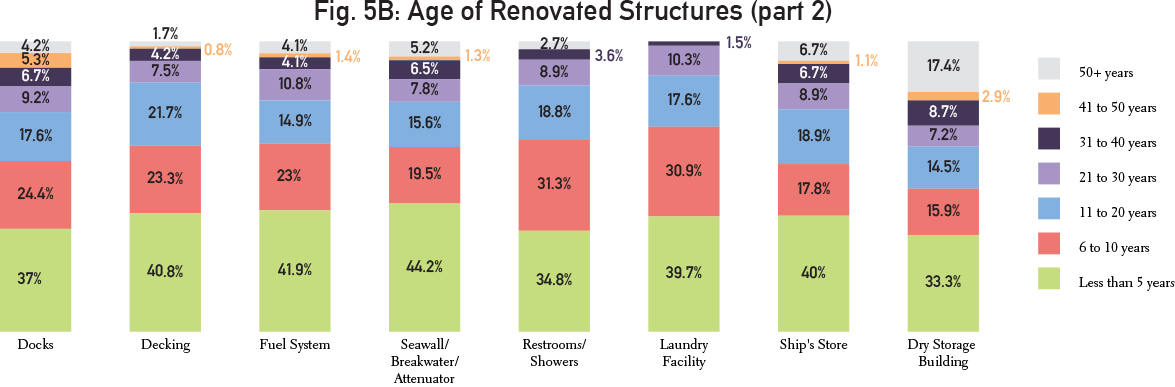

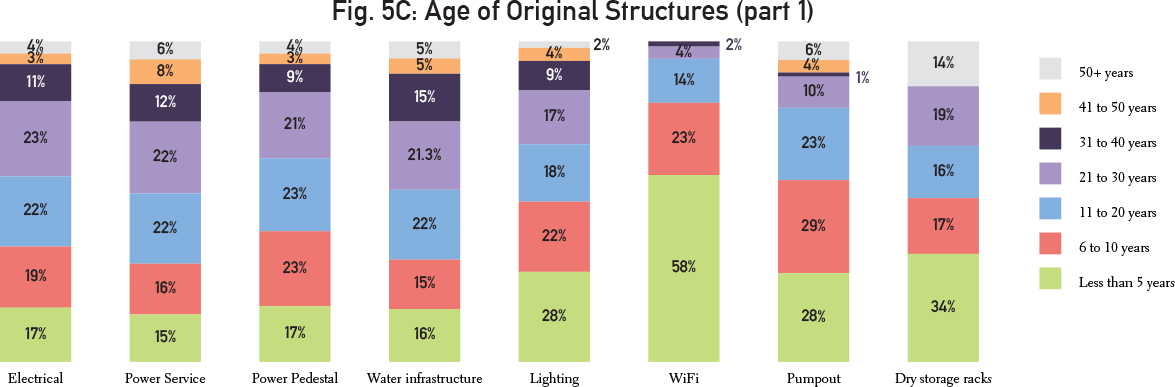

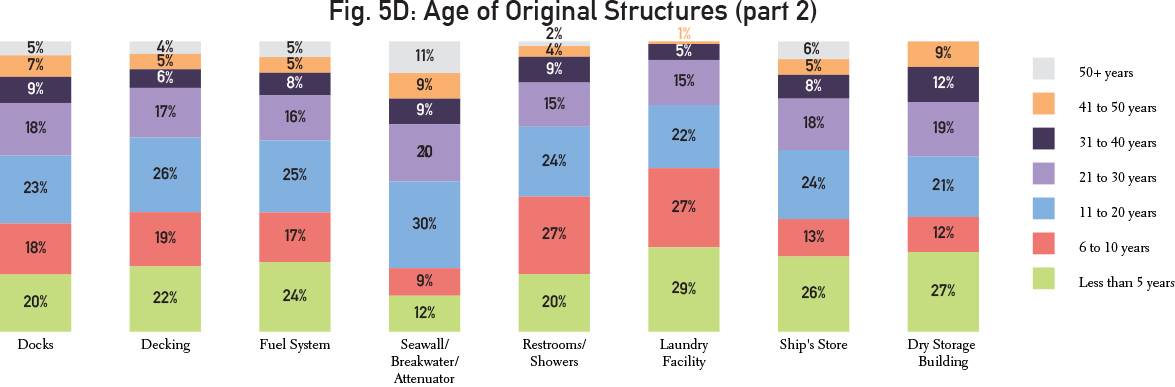

Many structures within marinas/boatyards have been renovated within the past 5 to 10 years (Fig. 5A and 5B). Water infrastructure is the outlier with it having been in place for up to 40 years for 55% of respondents. Original infrastructure widely varies as to its longevity across the many types. Wi-Fi and storage racks have been the most recent additions, while water, power, and electrical are more likely to be original to the facility.

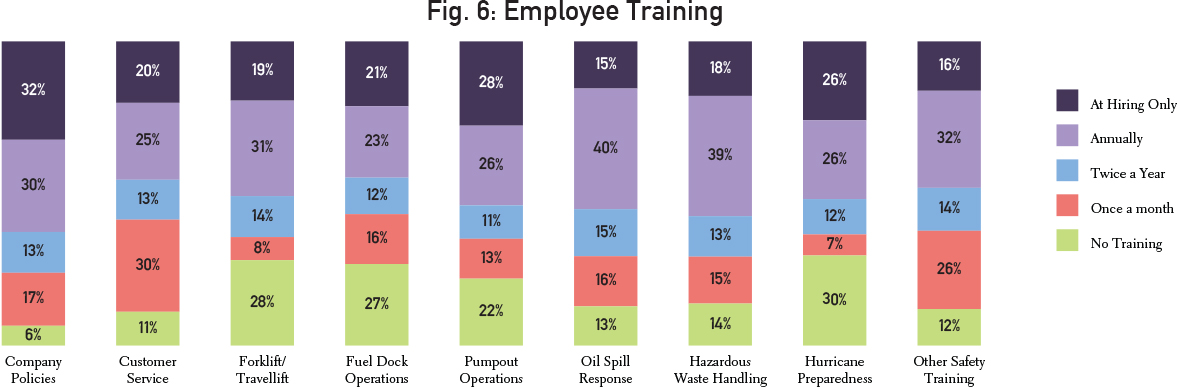

Fig. 6 indicates that training across all categories occurs mostly at hire or annually rather than more frequently.

| Categories | |

| Tags |