2024 Annual Survey: Occupancy Rates Remain Steady, Inflation Impacts Slip Rates

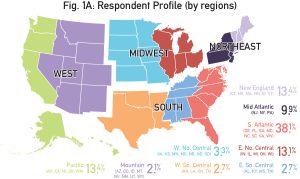

Published on March 4, 2025Editor’s Note: The Marina Dock Age Annual Marina/Boatyard Trends Survey was open November 2024 through February 2025. The survey includes operations and trends results for an expanded view of the marina/boatyard industry. Respondents from across the country answered questions about their facility, operations, revenues, profits and more.

Respondent Profile

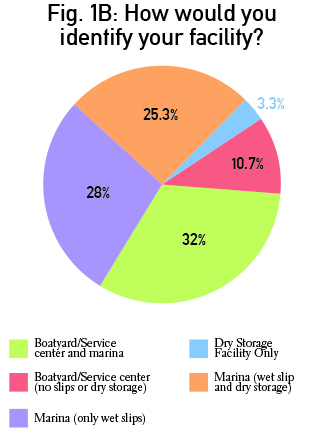

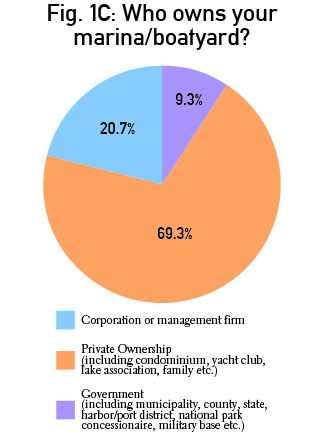

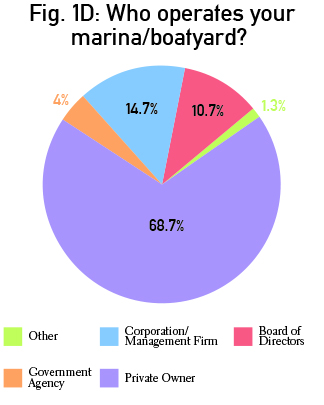

The respondent profile this year was a mix of marina and boatyard with 32% identifying as a Boatyard Service Center with Marina (Fig. 1B). Private ownership and operation continue to lead over corporate or public (Fig. 1C & 1D).

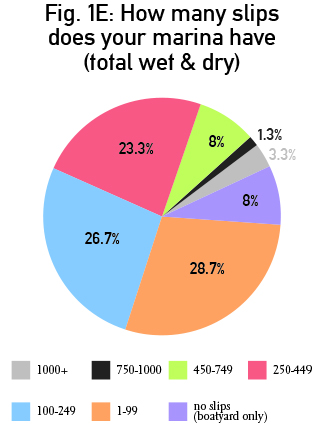

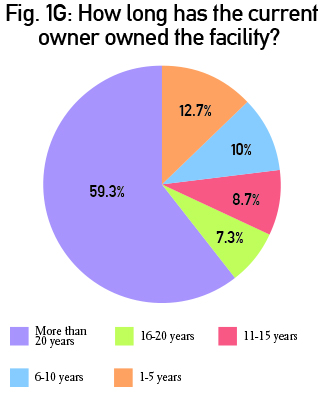

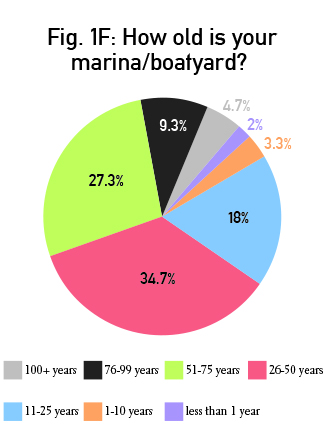

Most respondents had fewer than 500 slips (Fig. 1E) with just over 28% indicating the facility had less than 100 slips. Only 5% of marinas were in business less than 10 years with 14% listing facilities more than 76 years old (Fig. 1F). This reflects the lack of new building opportunities available. More than 60% of owners had been at the helm for more than 20 years Fig. 1G).

Occupancy Rates

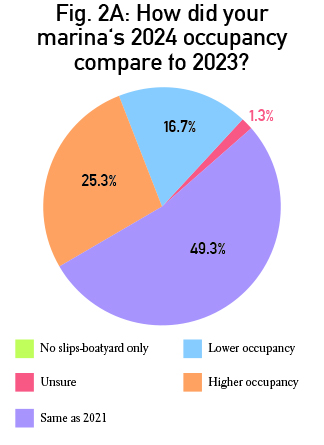

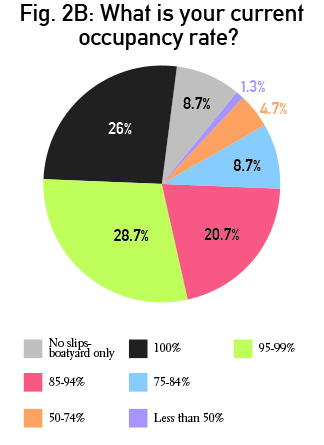

Higher occupancies continue to be the norm with 53% having the same occupancy as 2023 and just 18% citing a lower occupancy (Fig. 2A). 56% had occupancy rates greater than 95% (Fig. 2B).

Expenses and Profits

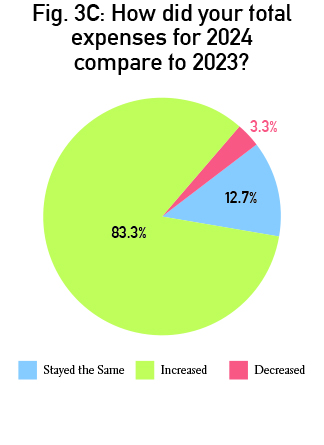

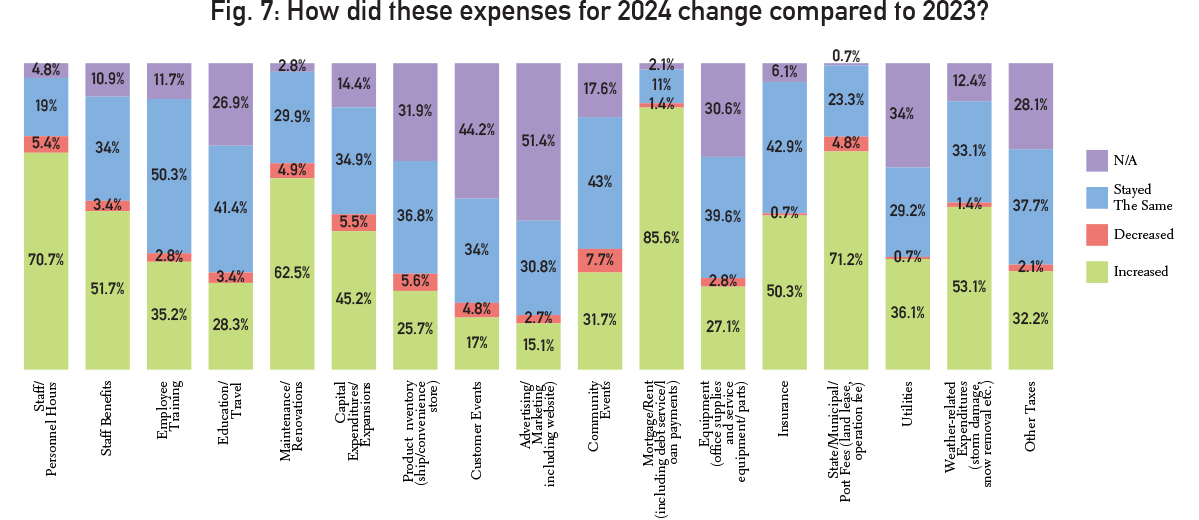

Inflation hit the industry this year with 84% of respondents saying expenses increased this year (Fig. 3C). Insurance costs rose for 85% of respondents, with utilities costs rising for 71% and staff costs climbing for 70% (Fig. 7). Expenses tended to hold steady for areas where owners have more control like training, marketing and inventory.

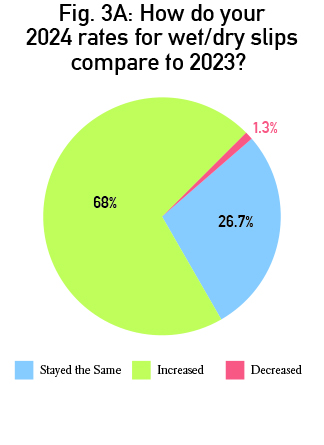

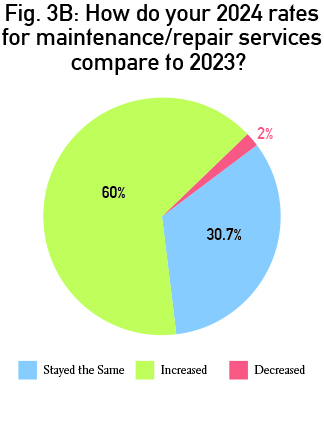

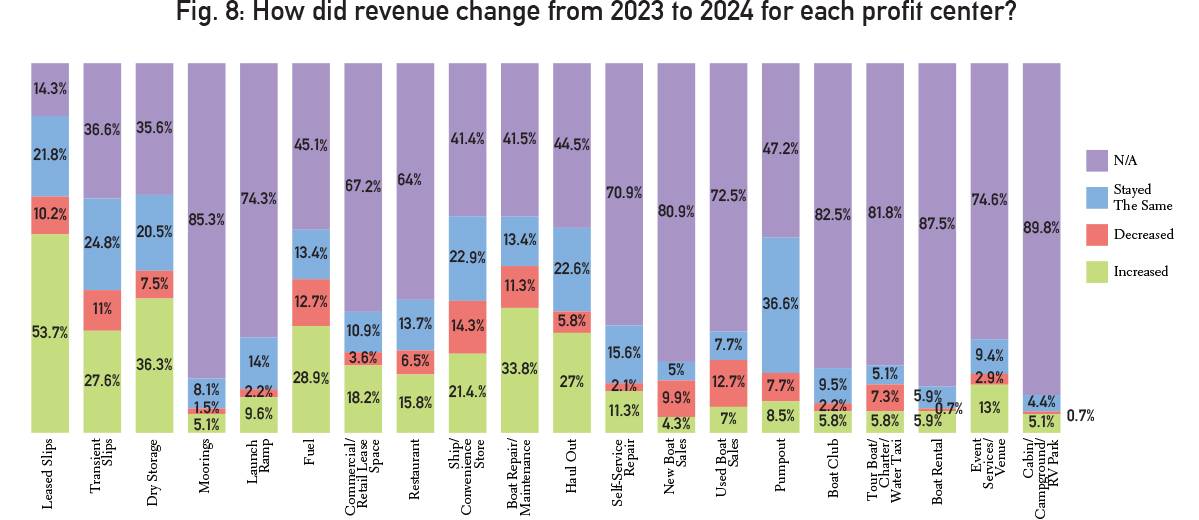

The increased costs were passed along to customers with 70% increasing slip fees (Fig. 3A) and 60% increasing service rates (Fig. 3B). Consequently, year over year revenue increased across these categories. Fuel sale revenues also increased, while many other revenues remained the same (Fig. 8).

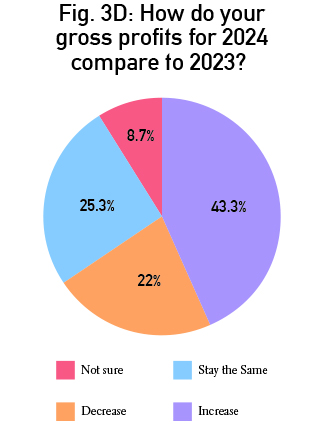

In a shift from 2023, when gross profits increased year over year for 64%, this year’s survey showed just 44% saw an increase in profits with 22% citing a profit loss (Fig. 3D).

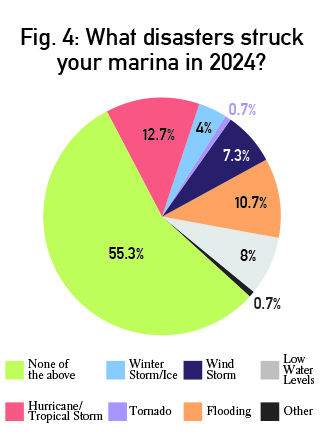

Natural Disasters

On better news, 55% of marinas were not impacted by any natural disasters this past year, although 23% had issues from hurricanes and flooding (Fig. 4).

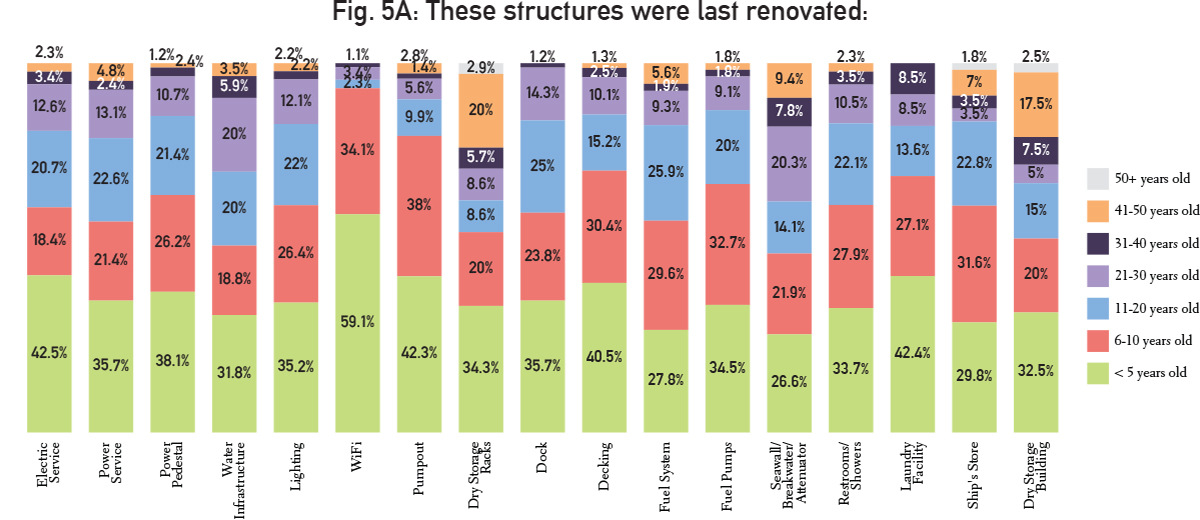

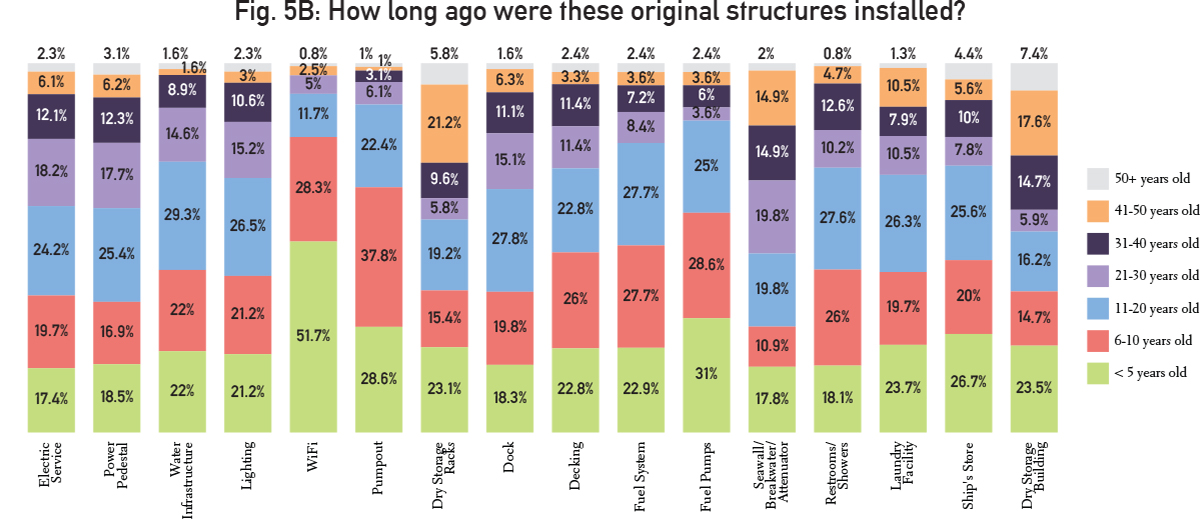

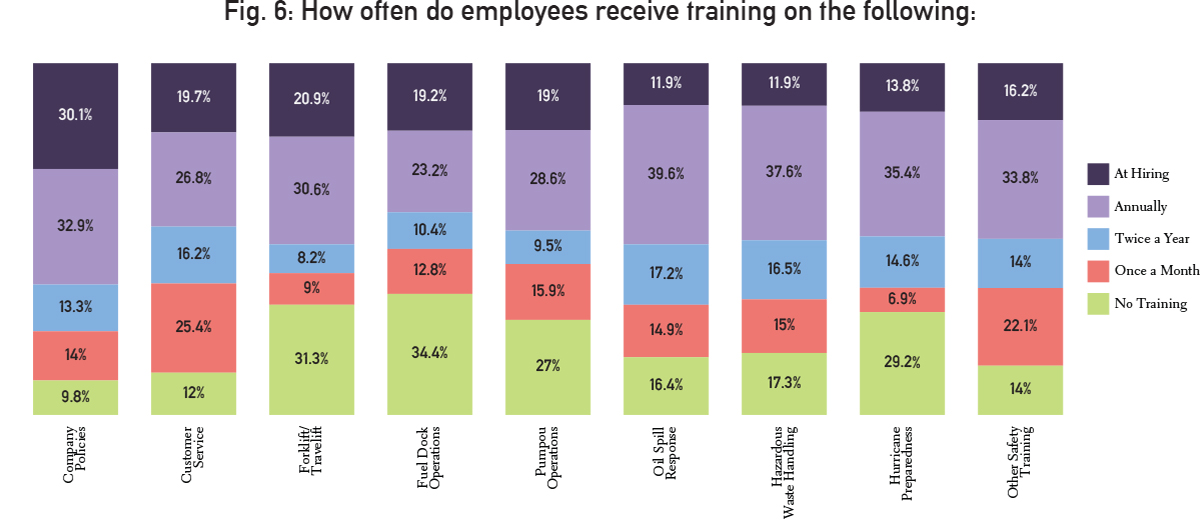

Infrastructure and Training

The majority of respondents indicated of the many structures on-site that are not original but renovated, most had been renovated within the past 5 years (Fig. 5A). Very few structures seemed to have held on for longer than 20 years. Original structures on-site also tended to have been put in place within the past 20 years. Wi-Fi stands out as the “youngest” service structure with dry storage racks and buildings being some of the older structures (Fig. 5B).

Respondents reported annual training was the favored training schedule, with just a few conducting training more frequently. (Fig. 6).

| Categories | |

| Tags |